Leading our way to the future we want to see

Led by a professional management team with extensive industry expertise,

we are committed to making feed ingredients more accessible to producers worldwide while promoting sustainability and ethical business practices. Through continuous education and innovation, we empower industry stakeholders with the latest advancements in animal nutrition and feed production.

With a strong international presence, LIONPRO operates across Africa, Latin America, Europe, and Asia, catering to diverse markets with customised supply chain solutions including sourcing, quality management, custom clearance, industrial processing, and inventory management.

in 2024

turnover in 2024

feed ingredients

sold in 2024

feed products

ethical approach

and more effective production process

FINANCIALS

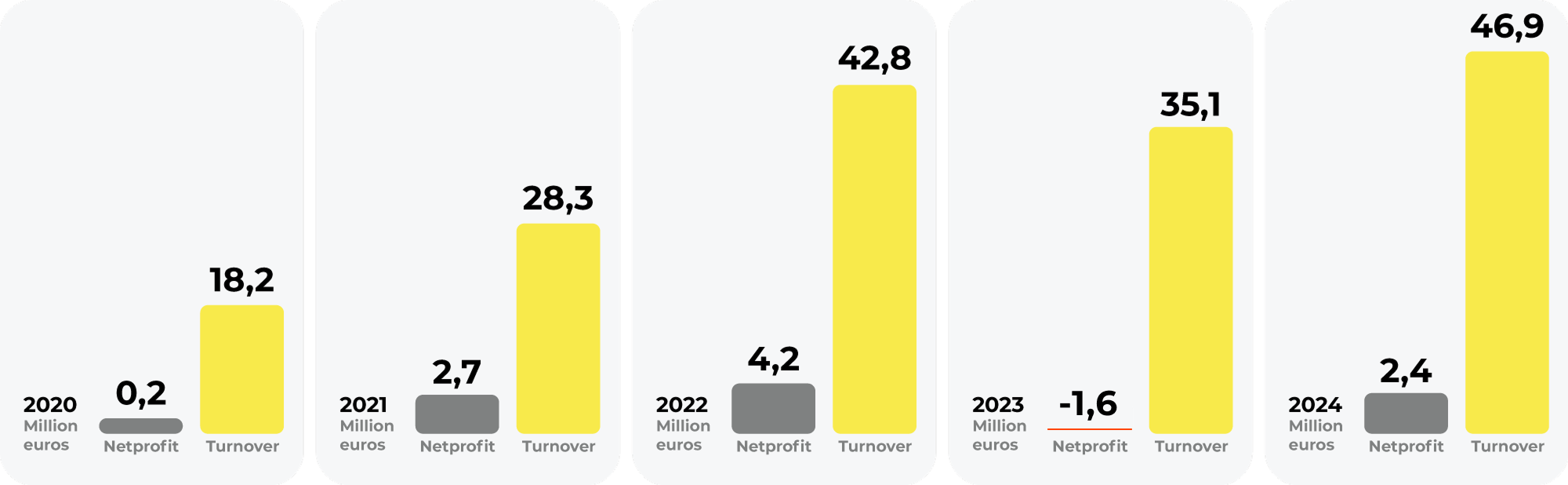

L. J. LINEN closed the year 2024 with a net profit of EUR 2,423,561, marking a strong recovery compared to 2023. This strong financial performance reflects the recovery of a key product group from the downturn experienced in 2023, stabilization of prices, and improved performance of the Company’s subsidiaries and related entities in international markets, where core business products are distributed.

The Company’s net turnover increased by EUR 11.6 million, reaching EUR 46.9 million in 2024 compared to EUR 35.3 million in 2023 — a 32.9% increase. Gross profit rose by EUR 1.8 million, with the gross profit margin improving from 10% in 2023 to 12% in 2024.

In 2024, L. J. LINEN also achieved a record-breaking product sales and shipment volume of 132,000 tons, accounting for approximately 10% of the European Union’s total exports in this specific product category. This milestone underscores the Group’s growing relevance in international trade and supply.

Additionally, the Company established three new subsidiaries in Asia and Latin America, laying the groundwork for expanded local market supply and deeper regional integration in 2025.

Looking ahead, L. J. LINEN remains focused on scaling its operations sustainably, diversifying geographically, and strengthening its leadership position in the global animal nutrition industry.

LINEN

L.J. LINEN audited annual review 2024 L.J. LINEN_9M 2023_operating financials L.J. LINEN_H1 2023_operating financials L.J.LINEN_Q1 2023_operating financials L.J.LINEN_audited annual review_2022 L.J.LINEN operating financials_2022 L. J. LINEN_audited annual review_2021LIONPRO Group

2025_06_30_LIONPRO Group_Operative reportANNOUNCEMENTS

BONDS

Nasdaq Bell Ringing Ceremony, 09.03.2023

ANNOUNCEMENTS

LINEN PLANS NEW BOND ISSUE

Latvian company Linen (SIA “L.J.Linen”) is planning to return to the capital markets with a new bond program aimed at supporting the company’s dynamically growing long-term development and financial strategy.

The bond issue will be carried out as a private placement, and the bonds are intended to be listed on the Nasdaq First North market. Linen has signed an agreement with Latvia’s leading investment bank, Signet Bank, as the arranger of the issue.

The new bond program is a logical continuation of the company’s first international bond issue carried out in 2022, which attracted strong investor interest and was repaid ahead of maturity. This experience has served as a valuable foundation for building trust with investors and clearly demonstrates the company’s financial discipline, stability, and responsible approach to its obligations. The funds raised through the bond issue will be used to increase the company’s working capital, allowing for significant turnover growth in existing markets. The foundation of this growth lies in a scalable, modernized, and financially disciplined operation.

“Our first bond issue proved that the private capital market in Latvia is attractive and open to companies with a clear vision and thoughtful strategy. Bonds are an important development tool for us, providing not only funding but also imposing discipline and increasing transparency in the eyes of investors. We are choosing this path as a key part of our growth strategy. At the same time, we are also working on implementing SAP – the world’s most reliable financial accounting tool – to strengthen our internal management and ensure even greater transparency. We see significant potential in new markets where demand for our delivered goods exceeds our ability to respond quickly with traditional financing instruments. With this issuance, we significantly strengthen our market position and take the next step toward broader presence in South America, Asia, and Africa,” explains Linen CEO Jānis Kuļikovskis.

“Linen is a compelling example of a local company that is goal-oriented and financially disciplined, using the advantages of the capital markets to implement ambitious global development plans. The added value of the capital markets is not just in the funding received – it helps improve the quality of corporate governance, enhances company visibility, and strengthens long-term credibility. These factors are crucial for ensuring competitiveness in the global market. At Signet Bank, we are proud to be partners with local companies that leverage capital markets for sustainable growth and reinforce Latvia’s business presence worldwide,” says Roberts Idelsons, Chairman of the Management Board at Signet Bank.

Linen continues its expansion beyond Europe and in 2025 is focusing on developing its operations in Asia, South America, and South Africa. The company plans to establish new distribution structures in these regions to reduce delivery times and be closer to customers in areas with underdeveloped logistics infrastructure. At the same time, Linen aims to further strengthen its “one-stop shop” concept, offering both large and smaller clients access to a wide range of raw materials at stable and competitive prices, regardless of global market fluctuations.

The company is one of the five largest exporters of animal-origin raw materials in the European Union. Linen closed 2024 with record-high operational results, demonstrating significant growth and strengthening its position in the global market.

The company’s net turnover increased by EUR 11.6 million, reaching EUR 46.94 million, while net profit amounted to EUR 2.42 million – a substantial increase compared to 2023.

Bērziņa